Are you entering into retirement soon? Are you considering retirement? Will you have enough money?

Today, we’re discussing the importance of retirement and estate planning. It’s a broad subject that covers a lot of ground. Given the variety and complexity these topics can have, there is no one size fits all cookie cutter approach that can be taken. The most important thing that we’re going to review is the importance of tax planning when it comes to your retirement cash flow and how it fits into your overall retirement peace of mind.

How much do you need to retire comfortably?

Every client we have met with, has unique goals, objectives, lifestyle needs and retirement plans…so the answer is “It depends”. There is no set amount that will fit everyone’s retirement plans. Our approach is about reviewing how our client envisions their retirement? How will you spend your time? What kind of travel do you enjoy? Will you have debt in retirement? What do you spend today on your lifestyle?

People use to discuss that you needed 70% of your pre-retirement income to live comfortably, however this is certainly not a golden rule and likely may not be right for you! We prefer to incorporate your lifestyle needs into your cash flow projections to ensure you can enjoy your desired retirement lifestyle.

What is your ideal retirement age?

Ask yourself this important question “If you knew you could afford to retire and live your desired retirement lifestyle starting tomorrow, would you?” In general, there is certainly no right age to retire, but more so, do you have created a written financial plan to achieve this objective?

We get client’s that love their job and want to continue to work as long as they are healthy and others who can’t wait to get out. Some clients will wait until their debt is paid off or they reach the magic age for full work pension benefits. Some clients may retire younger from their current career and start a business or take on a whole new career. It’s important to ensure you have the financial resources in place to retire at your desired age and enjoy the retirement you want.

What are your sources of retirement income?

When meeting with our clients to discuss this, we look at all their potential sources of income to ensure they can meet their goals. This can include but not limited to CPP (Canada Pension Plan), OAS (Old Age Security), company defined benefit pension plans, RRSPs, RRIFS, investment proceeds, non-registered investments, rental properties and TFSAs. For most clients that worked as employees for a company, the bulk of their retirement income will come from their own RRSPS/RRIFS or a company defined benefit pension plan.

This type of pension plan provides you with a consistent monthly benefit for life, thus leading to a guaranteed income stream. Some pensions will have indexing benefits attached, which increase these benefits over time to keep up with the rising costs of living. Your OAS benefits can be started at age 65 and must be applied for up to 6 months prior to your desired start date. This benefit is a set amount and based on the number of years you lived in Canada as an adult (40 years = max benefit).

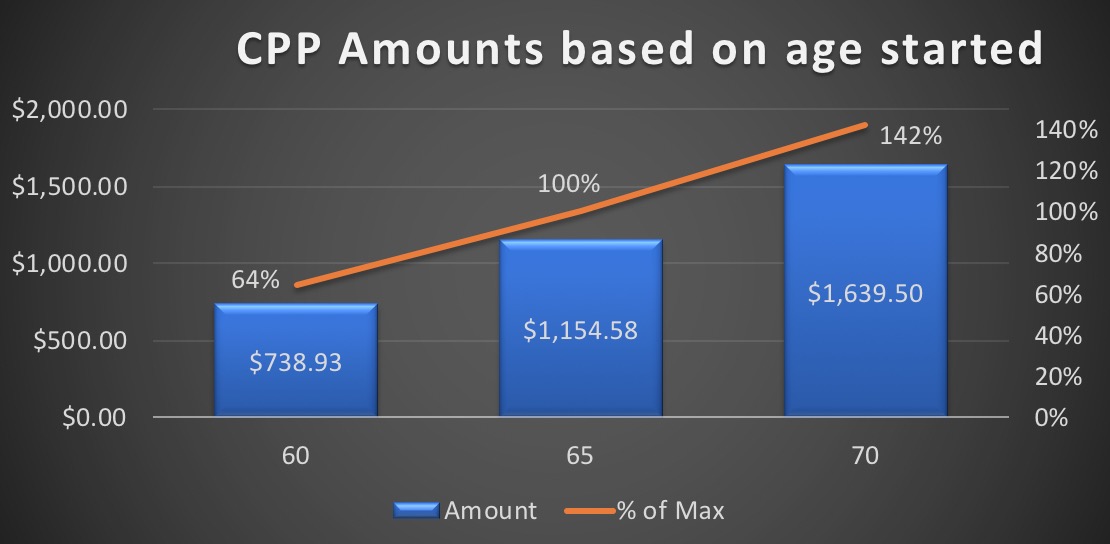

As for your potential CPP benefit, this varies as it is based on your contributions through your working career and when you decide to take the benefit. We recommend contacting CPP or going online to determine your eligible benefit.

When should you start your CPP?

This is very likely the most popular question we get asked and you should know, there is no right answer for everyone! You have the ability to start collecting at age 60 or deferring up till age 70. The government gives you a reduction of .60% for every month you take it prior to age 65 and a bonus of .70% for every month after age 65.

*Based on current full monthly CPP entitlements for March 2019.

https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/amount.html

Important factors to consider:

- Do you have any health or life expectancy concerns?

- Do you require the funds to meet your lifestyle needs or current obligations?

- Are you still working while receiving the funds? If so, how much is just going to taxes?

- If this is surplus cash, are you spending or saving it?

What sources do incorporated clients have for retirement?

Clients’ who have the benefit of being incorporated have the unique opportunity to retain additional cash inside their operating company or holding company. This forms their piggy bank for retirement. In retirement you are drawing on income from the company, so the Holding Company is likely paying you a regular monthly dividend and annual dividend. As the corporate tax rules and passive income rules are constantly changing, it is important to keep up to date on the rules so that your retirement goals remain on track.

What order should I draw down my retirement funds?

Now this is a great question! Often the key to retirement cash flow success is effective tax planning! You are likely drawing income from multiple sources and some of these sources are all taxed at a variety of rates. We want to focus on your after-tax income need for your lifestyle and how we can achieve that by paying the least amount of tax. Part of this is taking advantage of your tax brackets and drawing down assets in the right order. We must factor in how we’re going to do that by optimizing your cash flow.

You have to be tax efficient because a drawdown from an RRSP is not the same as a drawdown from a corporation, which is definitely not the same as a draw down from a pension…so all of these have to be factored into what we do. With our team of experts, we will ensure we factor in all your unique income sources to optimize your retirement income.

Why is pension income splitting so important?

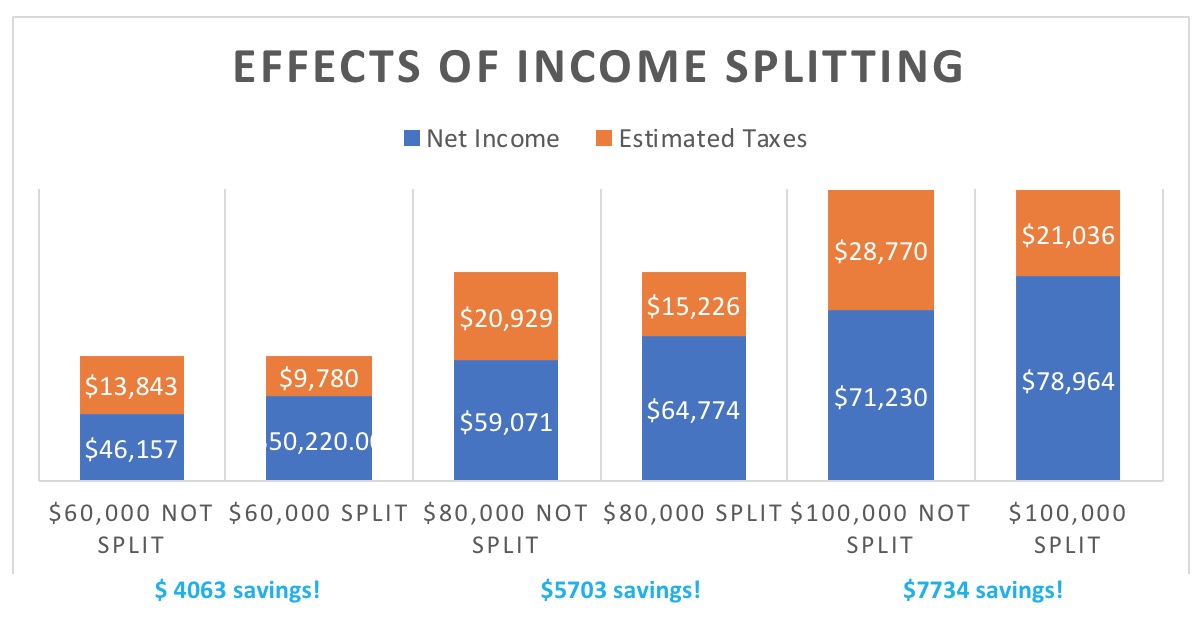

In retirement you get to split certain types of income between spouses. The goal of this is to have each spouse in a similar tax bracket to reduce your overall income taxes as a couple and increase the amount of net income you can enjoy! We have shown a few examples in the graph below, which illustrate the difference in one spouse claiming all the income vs the effects of pension income splitting at 50-50 split.

The one example shows a couple splitting a $100,000 of income, this results in an estimated $7734 increase in after-tax money that they can enjoy! We recommend reviewing how to make the most of your income splitting opportunities.

*Based on estimated Manitoba Tax rates using EY.com tax calculator and assuming a full 50/50 income split vs one spouse having 100% of the taxable income. OAS claw back and tax credits are not factored into calculations. Information is intended for illustration purposes and not implied tax advice.

Importance of Estate Planning?

Now, a properly documented estate plan should be multi-faceted including having your legal wills, powers of attorney, health care directives and updated beneficiaries on your insurance or registered assets. But just having those documents in place, does it truly stop there?

The answer is NO!

Those are crucial to ensuring your wishes are followed in the end, but what about tax planning? Yes, that is often overlooked, and you may not care, as you will not around anymore…but would you rather see your estate and wealth that you worked so hard for, go to CRA or to your beneficiaries?

If you are like every client I have worked with, you will want to minimize the amount of your final estate tax bill. Completing a full estate plan certainly helps identify this amount and provides direction as to how to best deal with it.

A thorough insurance review is a huge portion of that conversation. Using a permanent life insurance solution is one of the most powerful estate tools you can access!

Conclusion

When it comes to Retirement and Estate Planning, there is no simple answer that works for every situation. At the end of the day, a customized plan should be created that is based on your unique financial situation, while factoring in your goals and objectives. By incorporating a detailed estate plan, your executor will have a simpler process, the estate will be easier to distribute and ideally pay the least taxes possible.

A detailed estate plan should also include planning for mental incapacity as to one’s financial affairs and personal health care decisions. Most people do not wish to consider their own death or deal with such uncomfortable areas, however, a quality estate plan is a key pillar of your overall financial plan.

A well-thought-out estate plan is something your loved ones will not only appreciate, but also greatly benefit from as it can help save them time, effort and added stress, during an already difficult time.

As with most areas of financial planning, there is no “one size fits all” approach and not every person has complex needs or requires an extremely multifaceted estate plan. There are a few basics that should be considered regardless of your financial situation which we will cover in this guide.

Sign up for our

Exclusive Investment Planning Masterclass:

How To Build A Secure Investment Portfolio

That Can Help You Retire WHEN You Want, HOW You Want!